HELOC Rates in 2024

In 2024, Home Equity Line of Credit (HELOC) rates are influenced by a range of factors that reflect both the broader economic environment and the specific conditions of the housing market. A HELOC allows homeowners to borrow against the equity in their homes, with interest rates typically tied to the prime rate, which is the interest rate banks charge their most creditworthy customers, plus a margin determined by the lender. The prime rate, in turn, is affected by the Federal Reserve's monetary policy decisions. In recent years, the Federal Reserve has made adjustments to interest rates in response to economic conditions such as inflation and employment levels, which directly impacts HELOC rates.

Inflation remains a significant factor affecting HELOC rates. When inflation is high, the Federal Reserve may increase the prime rate to cool down the economy and prevent prices from rising too quickly. This results in higher borrowing costs for HELOCs, as lenders pass on the increased costs to borrowers. Conversely, in periods of low inflation and stable economic conditions, interest rates may be lower, which can result in more favorable HELOC rates. Additionally, changes in the Federal Reserve’s stance on interest rates can lead to fluctuations in HELOC rates, creating variability that borrowers need to manage.

Regional differences also play a role in HELOC rates. In areas with rapidly appreciating home values and strong demand, lenders may offer more competitive rates to attract borrowers, while in regions experiencing slower growth or declining property values, rates may be less favorable. This regional disparity reflects the varying levels of risk associated with lending in different housing markets.

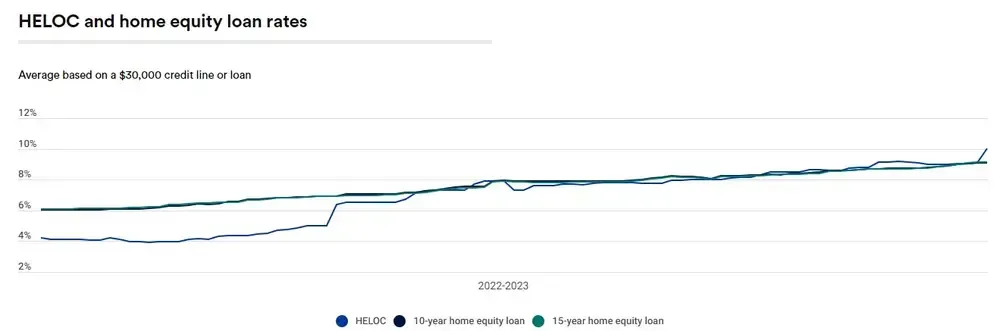

Comparing HELOC rates with other financing options reveals their advantages and disadvantages. Unlike home equity loans, which provide a lump sum with a fixed interest rate, HELOCs offer a revolving line of credit with variable rates. This flexibility allows borrowers to access funds as needed, but it also means that rates can fluctuate. Compared to personal loans and credit cards, HELOCs often offer lower interest rates, making them a cost-effective choice for significant expenses or consolidating high-interest debt.

Looking ahead, the outlook for HELOC rates will depend on ongoing economic developments, including potential changes in inflation, Federal Reserve policies, and housing market trends. Homeowners should stay informed about these factors and consider their impact on borrowing costs. By understanding how economic indicators and market conditions affect HELOC rates, borrowers can make informed decisions and optimize their financial strategies.

Apply for a HELOC and Get an Offer in Just 30 Seconds Below:

Fastheloc.com

24 Executive Park #250, Irvine, CA 92614

License Information - For complete license information, click here to visit our Licensing Page.

WCL is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate based on race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract) because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580.

Copyright ©

2024

West Capital Lending, Inc.

All Rights Reserved. | NMLS# 1566096 DRE# 02022356 -

NMLS Consumer Access